Michael Burke: This is from the IMF’s latest Interim Staff Report (in effect making sure the Dublin government is doing as it’s told). To quote one section of the IMF Report: [click to enlarge]

Two points:

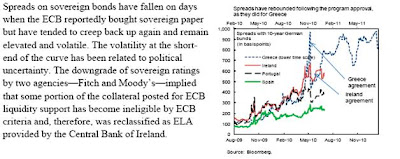

• According to IMF, Irish yields have only been falling because the ECB have been buying bonds- other market participants don’t want to touch them (as of yesterday 10yr yields are back over 9% and closing in on the previous high). This deal is making any future market access less, not more likely

• The chart shown is the IMF’s and suggests that Irish debt yields are going the same way as Greece did after its EU/IMF programme was announced

Market yields reflect an underlying truth. Ireland is becoming less creditworthy as its resources are depleted. This economy is no being bailed out- if it were yields would be falling as the outlook improved. Irish taxpayers are bailing out EU banks – and the outlook is deteriorating because of it.

No comments:

Post a Comment